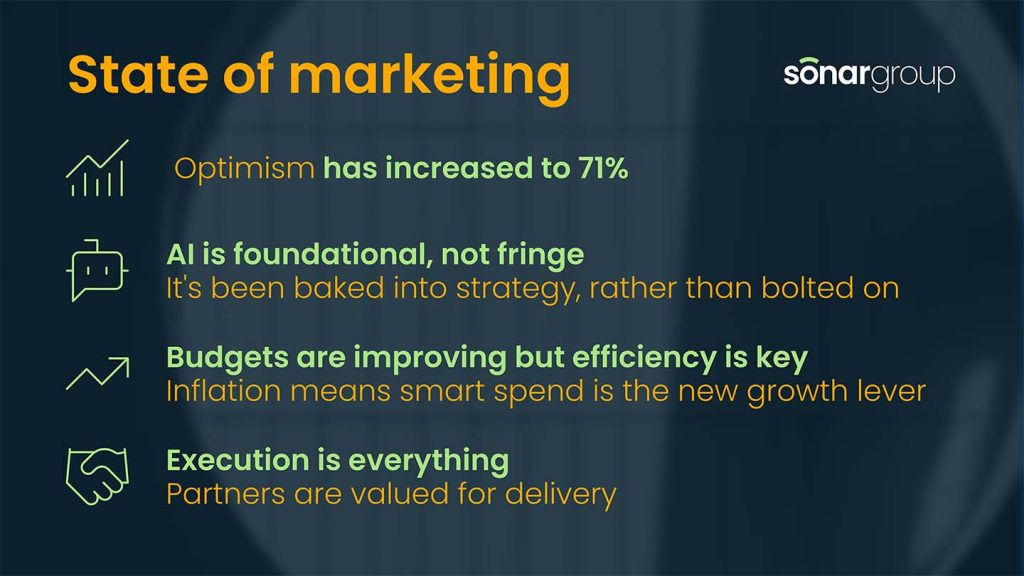

AUSTRALIA – Confidence among Australian marketers has surged to its highest point in three years, with 71% of professionals expressing optimism for the year ahead, according to Sonar Group’s Australian Marketers Benchmarking Report 2025. The findings mark a significant 15% rise from 2024’s sentiment levels and reflect a sector stabilising after several years of turbulence.

Now in its third edition, the annual report captures the evolving mindset of senior marketing leaders across the country. With budgets levelling out and clarity growing around how to integrate automation and artificial intelligence (AI), the marketing landscape is shifting toward more efficient, sustainable growth.

at Sonar Group

Scott Heron, Managing Director and Co-Founder at Sonar Group, says: “It’s great to see some confidence re-entering the market, and that is showing in the way clients are approaching their marketing activities. The optimism is real, but it’s not naive – marketers know the stakes are high and they’re making smarter and more strategic moves in response.”

AI: From Buzzword to Business-as-Usual

Generative AI has moved beyond experimentation and into everyday marketing operations. Adoption has climbed dramatically from just 20% in 2023 to 70% in 2025 with teams increasingly using the technology in areas such as content creation, workflow support and data driven insights. However, many marketers are still working through the challenge of translating AI adoption into tangible impact.

Automation Takes Centre Stage

Efficiency remains a key priority in the face of evolving consumer expectations and cost pressures. Marketing automation is now the top investment area for 58% of marketers – up from 49% in 2024 and only 17% in 2023. The report points to a growing imperative for scalable delivery models that support more personalised, responsive marketing.

Budget Confidence Returns

While inflation remains a moderating factor, 76% of respondents anticipate that their marketing budgets will either increase or remain steady. This stability is helping to ease the anxiety that dominated much of last year and is enabling teams to plan and execute with more certainty.

Teams Evolve, Not Shrink

Despite widespread speculation about AI’s impact on employment, 70% of marketers expect their team size to remain the same or grow. Rather than replacing talent, AI is catalysing a shift in team capabilities, with leaders focusing on upskilling in areas such as data literacy, personalisation, and AI integration.

Marketing’s Strategic Role Reaffirmed

The report also notes a rise in marketing’s perceived value within organisations. Seventy-two percent of marketers believe their department is now viewed as a value driver or strategic cost centre, up from 64% in 2024. This reflects a broader recognition of marketing’s commercial impact in a competitive, digitally driven environment.

Heron adds: “What’s interesting is the sentiment we’re seeing around emerging tech like AI. Two years ago, it was met with uncertainty and scepticism because of so many unknowns – now, it is being used to enable marketers and enhance performance. It’s no longer a side project, it’s becoming increasingly embedded in the day-to-day of marketing teams and is fundamentally reshaping how brands operate.”

Sector-specific trends also point to a changing landscape. Highlights include:

- Retail marketers leading the confidence curve, with 82% positive about the year ahead.

- Financial services marketers reporting high intent to invest in AI at 75% compared to the average 48%.

- Not-for-profits are more interested in upskilling their team in generative AI (86%), personalisation (86%) and data and analytics (57%) than the average.

As marketers balance tighter spending conditions with rising expectations, the report points to a shift in how leaders are operating. Execution is critical but there’s a growing appetite for partners who can deliver efficiently and support sharper, more commercially focused decision-making.

The 2025 report draws on the perspectives of senior marketing leaders, with over 82% of respondents holding roles such as CMO, CXO, Marketing Director or Head of Marketing, Brand or Digital. Respondents also spanned a range of industries – from retail and financial services to technology and not-for-profit – working within mid-sized organisations of 201–500 employees.

Download the full report here.