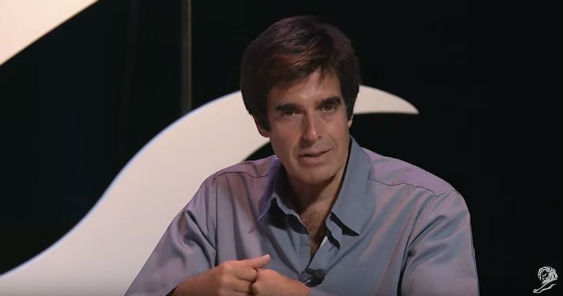

GLOBAL – UNITED STATES, APRIL 19, 2013 – In support of the national introduction of its Original Recipe Boneless on April 14, KFC has launched a marketing campaign that includes two new spots created by Draftfcb Chicago and directed by Academy Award-nominated Director David O. Russell (Silver Linings Playbook).

The first spot focuses on a dad and the second on a guy hanging out with his friends, both of whom literally enjoy every last savory bite of KFC’s original recipe (with boneless chicken) before being freaked out by the lack of bones. No, they didn’t eat them – and that’s what made this new menu option the most popular test product in KFC history.

The campaign also featured a new radio ad as well as digital banners across multiple sites, including a Yahoo! Takeover on April 17. The brand’s Facebook and Twitter streams kept the excitement going by continuing to use the hashtag #IAteTheBones, which came about organically thanks to enthusiastic customers and viewers in the initial test markets. Some customers even made their own YouTube videos, documenting their own “I Ate The Bones” moments when they tried the product for the first time.

CREDITS

Chief Creative Officer: Todd Tilford

Executive Creative Director: Chuck Rudnick

Creative Director: Doug Behm

Senior Copywriter: Zach Schmitz

Copywriter: Katie Rich

Senior Art Director: Heather Barnes

Executive Producer: Ivo Knezevic

Account Director: Vicky Runyon

EVP, Group Management Director: Rahul Roy

SVP, Management Director: Dave Trifiletti

Production Company: Wondros

Executive Producer: Gina Zapata

Producer: Helga Gruber

Director: David O. Russell

D.O.P: James Whitaker

Editor: Alex Hagon @ Hagon

Editing Company: Hagon

SoundDesign/Arrangement: John Binder @ Another Country

Post Production: Optimus