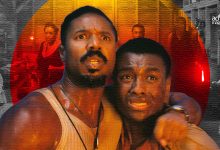

MANILA, PHILIPPINES — When Takeru Satoh first donned the robes and the cross-shaped scar on his cheek for the first Rurouni Kenshin movie in 2012, nobody probably thought that there would be a series of movies to follow. After all, the live-action adaptation of the popular manga and subsequent anime series by creator Nobuhiro Watsuki was a risky proposition at best. Nine years later, Satoh and director Keishi Otomo close the book on Kenshin Himura’s big-screen adventures with a fifth film, the prequel that is Rurouni Kenshin: The Beginning.

In 1864, Kenshin Himura (Satoh) has just begun his life as Battousai the Slasher, the dreaded assassin of the Choshu clan that aims to overthrow the Tokugawa shogunate. Working for Kogoro Katsura (Issey Takahashi), Battousai has proven himself to be a proficient, emotionless killer being hunted by the Shinsengumi or special police force. Among those looking for him is the officer Hajime Saito (Yosuke Eguchi). One night, Himura gets into an argument with a couple of revolutionaries while defending a woman named Tomoe Yukishiro (Kasumi Arimura).

After Himura takes Tomoe to their hideout, the pair bond because of the former’s philosophy on who he is supposed to kill. A series of incidents have the Choshu branded as rebels. Fearing the presence of a spy in the Choshu ranks, Katsura then arranges for Himura and Tomoe to pretend to be husband and wife in the village of Otsu. Over the course of their stay there, they become closer, start acting like a real married couple, and fall in love.

Living the domesticated life away from the conflict does wonders for Himura as he smiles more, content with Tomoe by his side. This makes the heartbreaking revelations about Tomoe’s real intentions and what her role is in giving him his trademark scars even more tragic.

When the original video animation (OVA) film Rurouni Kenshin: Trust & Betrayal was released in 1999, it finally explained for the first time how Kenshin Himura (known in North America as Samurai X) got those scars on his left cheek. It was a tragic story of love and betrayal and added to the popularity of the franchise even more. Rurouni Kenshin: The Beginning is largely rooted in that previous film and, as the other four live-action movies have been, continues the best series of anime-to-live-action adaptations in film.

This version of Kenshin barely shows emotion, wears only dark clothes, speaks softly, and without the “gozaru” subjugation at the end of his sentences that reflect his modesty. Nowhere will the reverse-edged sakabatou that Kenshin wields later be found and instead, a sharp katana is ever in his hands. This is arguably Kenshin at the peak of his powers, at his deadliest, but also at his loneliest. None of the familiar faces such as Kaoru, Yahiko, Sanosuke, or Megumi can be found and only a young, ponytailed version of Saito is seen opposite him.

This young Kenshin is used by forces to bring down the shogunate and he does so with cold efficiency. Yet he is also still a man and this is recognized by those who plot against him and use Tomoe’s own tragic story to bring the assassin down. The tale of Kenshin’s first wife has long been a popular point of contention for fans of the character as their love story and seemingly cursed ending has endured for over two decades now.

Satoh only showed this side of Battousai only in spurts in the previous four films because that Himura was older, was past his assassin days, and was surrounded by people who he could count as loved ones. Here though, Himura is dark throughout and when he allows himself a little bit of happiness, it is taken away so brazenly that one can understand why he would disavow killing forever.

Like in the previous films, Tomoe and the other characters here look like their anime versions come to life and Arimura portrays her quiet pain and hidden anguish perfectly. As she eventually falls for Kenshin, the flashbacks showing how her beloved Akira Kiyosato (Masataka Kubota) were slain by Battousai justify why she would plot against him. The tragedy that would befall them both for falling in love with each other is the conclusion that would fuel Himura in the years to come.

It has been no small feat for Otomo to make one, let alone five successful Rurouni Kenshin films. This fifth one doesn’t have the huge special effects and battles seen previously and instead; more one-on-one duels happen until the traps are laid for Kenshin during the film’s climax. These films have taken close to a decade to film for Otomo, Satoh, and Eguchi but the result has been rewarding to both old and new fans of the characters. As we bid the actors and characters goodbye, we do so gratefully for this wonderful ride that they’ve taken us on.