MANILA, PHILIPPINES — With slowly yet steadily rising global and ocean temperatures, coral reefs are some of the most vulnerable ecosystems on Earth. Many reefs around the world face the threat of bleaching, especially in the seas of the Philippines, one of the centers of marine biodiversity in the whole world, which had experienced bleaching years before.

Marine scientists haven’t lost hope yet, however, as they’re fighting back with the latest advancements in technology. The newest tech could help monitor and preserve these ecosystems and even bring damaged reefs back to life.

Sound solutions

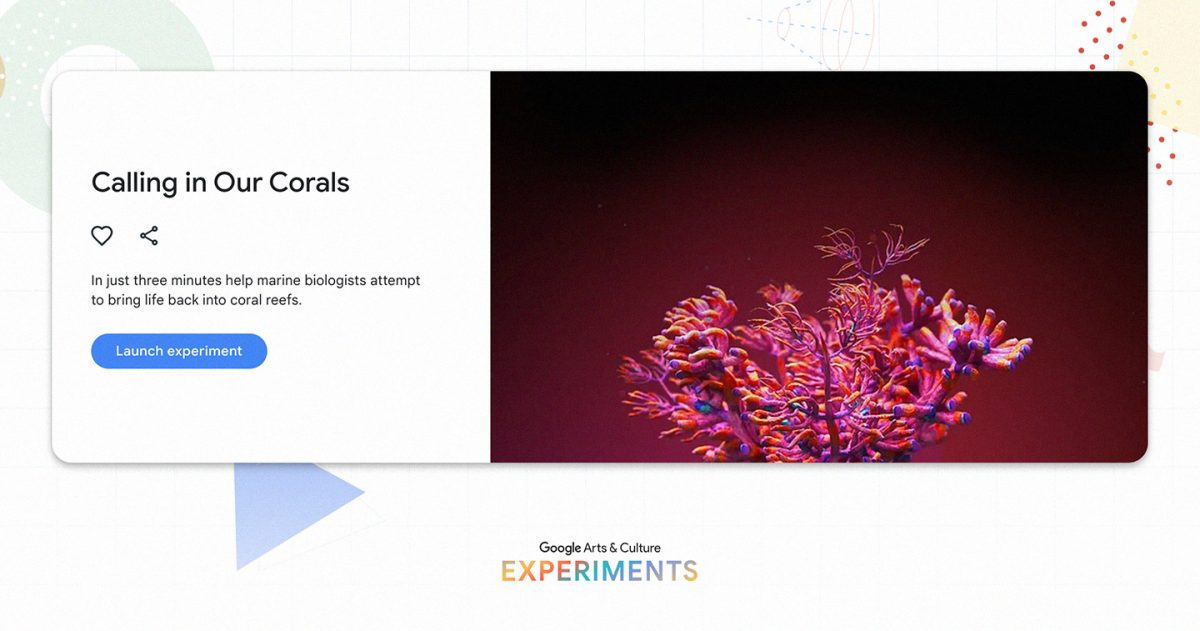

Google Arts & Culture recently partnered with marine biologists and ecologists to start the Calling in Our Corals project, which taps into the power of artificial intelligence to help monitor coral reefs.

Scientists have placed hydrophones, or microphones designed to be used underwater — on coral reefs around the world, including in marine protected areas. These devices record the sounds of marine life, providing new understanding on the health, biodiversity, and activity of animals in these precious habitats. New research has found that these sounds can even call in new marine life recruits when played back using underwater speakers in damaged habitats.

This is where AI comes in. It will develop a bioacoustic model that can help scientists monitor and track marine ecosystems, as well as accelerate their capacity for research in a way never done before.

People can help train the AI, too, by lending their ears and identifying various sounds of marine life taken from 10 reefs in countries such as the Philippines, Australia, Indonesia, the U.S., Panama, or Sweden. By doing so, they help the AI build valuable data on the health of these reefs.

There are months of recordings taken from around the world, and through listening to them, participants will become part of a listening collective of citizen scientists helping to identify all the fish sounds in the audio recordings.

Through the contributions of people around the world, scientists can start training AI models to listen to reefs, accelerate monitoring, and measure the success of marine protected areas and restoration programs. The ultimate goal is for AI to identify different species’ sounds automatically so experts can better understand the diversity of the ocean, and protect the rich natural resources all around us.

To participate and help in Calling in Our Corals, visit the Google Arts and Culture site here.