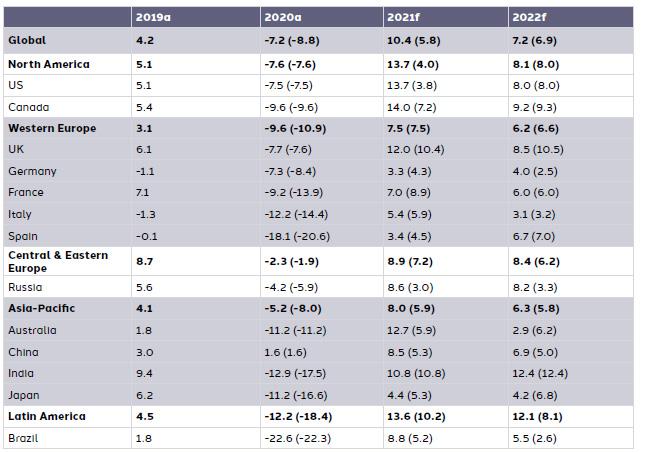

TOKYO, JAPAN — Advertising investment is forecast to grow by 10.4% globally in 2021, according to the latest dentsu Ad Spend Report. The twice-yearly report which combines data from 59 markets, anticipates US$634 billion will be spent globally with all regions enjoying positive growth.

Ad spend in APAC is expected to grow by 8.0% or US$17 billion to US$229 billion. In the region, Australia and India are forecasting particularly high growth rates in 2021, with 2021 growth expected to exceed pre-pandemic levels in China.

The pandemic-induced decline in advertising spend during 2020 has proved less severe than anticipated. Some trends in consumer behaviour and spend in advertising which emerged during the past year have remained.

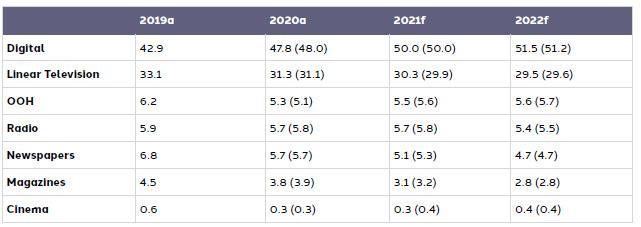

In APAC, the 6.2% rise in digital spend last year is forecast to grow by 12.8% in 2021 to reach US$124.5 billion, representing a 54% share of total ad spend. Forecasts for Social (33.4%) and Video (10.8%) will also rise, with Search also growing (7.8%) reaching US$23.1 billion in 2021.

Offline/Linear ad spend will see a return to growth 2.8% to US$104.8 billion, following a 15% decline in 2020, however it is predicted that spend levels in APAC will remain below pre-pandemic levels in 2021.

While regional live events such Tokyo Olympics and Paralympics Games continue to be a significant driver of growth in Linear TV ad spend in APAC (3.9% increase in 2021 to reach US$59.2 billion), the dentsu data suggests a shift towards CTV (Connected TV) and OT (Over The Top) and audiences moving more towards digital media consumption mean Linear TV spend will remain below pre-pandemic levels until beyond 2021.

With restrictions lifting on social activity, OOH will see a bounce back post impact of the pandemic, rising 7.5% in 2021 in the region. Cinema has a slightly longer recovery, with a further decline in 2021 (-5.0%) but is expected to bounce back in 2022. Radio will also see growth (4.3%) in 2021.

While most channels will return to growth in 2021 (Cinema in 2022), Print is seeing a slight decline in 2021 (–2.7%) and is expected to continue declining in 2022, as it continues to evolve towards new modes of digital delivery.

Looking at the industries that will see growth in ad spend this year, it will come as little surprise that Government spending remains a key growth area, supporting the Covid vaccine rollout and other related initiatives. In APAC’s key markets, the travel and transport sectors, will still be affected by the uncertainty of the past year and see a muted increase in demand (4.9%), while Media & Entertainment is forecast to see growth (9.7%).

The decline in APAC advertising spend prompted by the pandemic in 2020, has proved to be less severe than originally anticipated. While 2020 remains the weakest performing year since the global financial crisis, the decline in growth has been raised since dentsu’s January 2021 forecast (from -8.0% to -5.2%.) In 2021, the market is seeing a recovery in growth (8.0%), an improvement (2.1% pts) on January’s predication. Looking to 2022, recovery is set to continue when spending is likely to reach US$243.6 billion and grow at a rate of 6.3%.

Ashish Bhasin, CEO APAC, dentsu international, said, “It is promising to see a return to growth in the APAC region with two of our markets in the top five contributors of ad spend growth; China and Japan. While China continues to see strong levels of growth driven by Digital and OOH, Japan’s growth will be buoyed by events like the 2020 Olympic & Paralympic Games, and the House of Representatives elections, and the advertising spend associated with it, particularly in TV.

In addition, Australia and India are two of the top year-on-year growth markets, forecasting a surge in ad spend. Australia has had a stronger economic recovery after the pandemic particularly in TV and Digital where the government focused much of their Covid-related campaigns, while India is expected to see a resurgence in Digital advertising spend though TV is still the main contributor with a 40.9% share.”

Prerna Mehrotra, CEO Media APAC and MD Media Singapore, said, “We are optimistic that the region will bounce back to positive growth in ad spend, with some channels likely boosted higher than pre-pandemic levels. The main drivers behind the growth is economic recovery, with the APAC GDP set to increase by 7.3%, and a stronger-than-ever push to digital marketing.

Serving as a stimulus the pandemic has accelerated digital adoption. Digital media will continue to drive ad revenue growth this year with strong performance in social (+33.4%) and video (+10.8%) and majority of spends in mobile. We will also see more investments diverted towards addressable and the digitalisation of OOH channels.

Programmatic DOOH will also be a key growth driver in the future. With the growing numbers of SSPs and DSPs partnerships and an increasing demand for location-based solutions to ad-reaching consumers in these times of uncertainty, advertisers will benefit from the speed, flexibility and the targeting capability that the medium will provide.”

Growth in global ad spend between 2019 and 2022

Year-on-year % growth at current prices (January 2021 figures in brackets)

Share of global ad spend by channel between 2019 and 2022

January 2021 figures in brackets

January 2021 figures in brackets

The dentsu Ad Spend Report can be viewed here: https://bit.ly/3k4Ph8c