SINGAPORE — Reprise, IPG Mediabrands’ global performance marketing agency, has today released key findings from their newly completed consumer study conducted across 13 markets in the Asia Pacific region to reveal the key changes in online shoppers buying behaviour and preferences across the APAC region. The Reprise study, which was conducted in collaboration with Google during the first half of 2021, interviewed 13,000 shoppers (1,000 per market), across Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand & Vietnam.

KEY FINDINGS

- Online shopping outpaces traditional retail. In APAC, regular ‘a few times a month’ online shoppers are now outpacing their offline counterparts by 42% vs 31%. Those who shop online ‘once every few months’ leapfrog offline shoppers by 66%.

- Promotions and sales are the best way to engage SEA markets. 61% wait to shop online during the big sales days, vs the 39% ‘anytime’ shoppers.

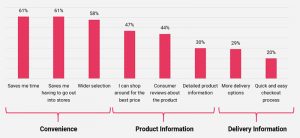

- Convenience is the eComm trump card. ‘Time saving’ and ‘finding best prices’ are perceived as the two biggest advantages by 76% and 65% of online shoppers.

- Dress-up to lock-down. Pandemic restrictions haven’t dampened consumers’ desire to look and feel good; the top 3 most shopped categories online in APAC over the last six months were; Clothing and Apparel (67%), Health & Beauty (47%), and Consumer Electronics (40%).

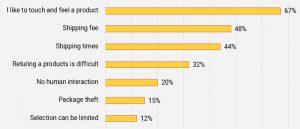

- Shipping fee is the biggest ‘turn-off’ for shoppers. The top 3 perceived barriers to online shopping are ‘shipping fee’ (57%), ‘shipping time’ (55%), and the inability to ‘touch and feel’ products before purchasing (48%).

- Good reviews go a long way. The top 3 shopper motivators when purchasing online are ‘good reviews’, ‘promotion/sale,’ and ‘good star ratings’ as voted by 60%, 54%, and 50% of online shoppers respectively.

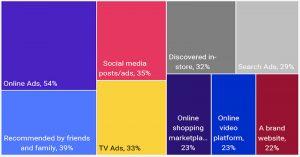

- Online ads are the key driver to engage new buyers. 1 in 2 online shoppers look to online ads for discovering new brands and products when purchasing online.

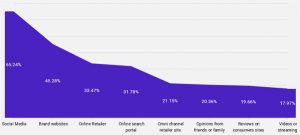

- Social media is king. Social media is now the top point of research for 42% of APAC shoppers.

According to Ritika Gupta, eCommerce Director Reprise APAC, and author of the report: “We have seen unprecedented growth in eCommerce in the last 12 months. Many markets in APAC have leapfrogged as much as 5 times, already meeting projections for 2025. This eCommerce acceleration is partly led by platforms that have fast-forwarded their interface roadmaps and advanced their technology. This, along with audience targeting via in-platform ads has played a significant role.”

APAC

The retail landscape in APAC which is very diverse and distinct from the rest of the world has evolved considerably since the onset of Covid-19. The global pandemic has led to explosive growth in the eCommerce industry. Consumers across the APAC region have shifted their shopping habits online to cater to life under pandemic-related lockdowns and restrictions, and these new behaviours are here to stay.

As consumers connect and increasingly shop online, brands are expected to tap into social media to virtually engage and build trust with shoppers, in addition to serving ‘shoppertainment’. Social media is now considered a top point of research and discovery for nearly half of all online shoppers. Along with the uptake in online shopping habits across the region we have noted a significant rise in concern from millennial shoppers regarding lead time in product delivery. 60% of millennial online shoppers now state shipping time as a big hindrance to their shopping decisions. The older generation of online shoppers prefers a more touch and feel experience; with 53% of the aged online shoppers attributing the inability to physically experience the product as the greatest challenge to online shopping.

As eCommerce continues to blur the lines between international borders, it’s now more imperative than ever for brands to tailor their marketing strategy to the locality of the region and markets that it serves. It is time to re-think eCommerce as a one-stop-shop, an e-business, and a data haven. And perhaps time to re-evaluate the function and value of brick and mortar retail as an experiential step in the eCommerce path to purchase.

According to Pippa Berlocher, President Reprise APAC: “The growth we’ve seen from eCommerce in the last 12 months is not unexpected, the impact of COVID has merely accelerated an already apparent trend. This acceleration provides a strong opportunity for brands to engage with consumers in a different way– consumers have proven that they are more open to engaging with new brands and products in an eCommerce environment, and brands who recognize this and adjust their digital strategy accordingly will reap the rewards. Additionally, APAC demonstrates again that there are fundamental differences in behaviour by market, and when it comes to eCommerce– brands that embrace a local first approach are the ones that are likely to see the most success.”

CHINA – KEY FINDINGS

- When it comes to in-store shopping, 63% of China shoppers shop ‘anytime’ and don’t wait for sales and promotions. Whereas 52% of online shoppers wait for sales season to make their purchases.

• The top 3 triggers for online purchases are ‘good reviews,’ ‘product information,’ and ‘good star ratings’ as voted by 71%, 64%, and 58% of online shoppers respectively.

- China online shoppers are loyal to their needs and not specifically to brands. 75% of shoppers say that they are willing to buy new brands that they see online.

• 1 in 2 shoppers discover new products via online ads, and 1 in 4 online shoppers said that live streaming helps them to discover new products online.

Being the first country to grapple with the COVID-19 crisis, the battle for China has not been as difficult as some other markets. China has been on the frontlines both of post-COVID-19 economic recovery, and of the social changes triggered by the pandemic. The lockdown measures accelerated an ongoing trend of online shoppers shifting away from traditional retail towards online channels. The preexisting refined digital infrastructure ensured that online initiatives launched in response to COVID-19 were well received and provided valuable service. Although order fulfillment is done in hours or days rather than the weeks it might take in less developed economies, shipping time is still perceived as a source of friction by almost 60% of China shoppers.

Livestreaming took the China eCommerce industry by storm. 1 in 4 shoppers consider this channel to be a useful source of discovering new products online. This is more dominant in categories like health and beauty, toys, and home and kitchen appliances. Another development that took place in China during the pandemic is community group buying. Platforms like PDD have become preferred places to shop for grocery and household items. It is also considered to be a platform that offers better prices and promotions by 60% of the online shoppers. Lockdowns, social isolation, a rise in health concerns, and an already blossoming delivery economy have culminated in favour of WeChat which has become the preferred platform for 47% of the shoppers in the food delivery industry.

INDIA – KEY FINDINGS

- Consumer reviews about a product, are perceived to be the biggest advantage by 64% of online shoppers in India.

- The top 3 motivators for online purchases are ‘good reviews,’ ‘good star ratings’ and ‘product information’ as voted by 70%, 59%, and 52% of online shoppers, respectively.

- Marketplaces like Flipkart and Amazon have ranked higher for product discovery across all categories in the last 12 months. 91% of online shoppers used Amazon and 81% of them used Flipkart for discovering new products.

- TV ads are still considered to be a significant channel, 64% of online shoppers in India refer to television advertisements for discovering new products.

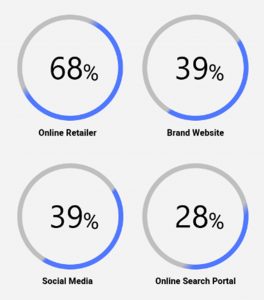

From logistics to supply chain to mobile penetration, eCommerce growth has been an uphill battle for India. However, the onset of the COVID-19 pandemic brought about multiple online shoppers’ behavioral changes, foremost being the rapid adoption of eCommerce. The growing demand, government policy support, and increasing investments have been some of the key drivers in the incremental growth of eCommerce in India. Shoppers in India have had a mass adoption of online shopping given the multiple lockdowns in different states. Shoppers engage in purchase experiences that include a multitude of touchpoints, all of which play a crucial role in the decision-making. While their purchase triggers and journeys differ from other markets, 70% of shoppers in India rely on the rating and reviews available on eCommerce platforms. Online retailers are highly sought after when shoppers are researching products at 68%, followed by social media at 39%.

JAPAN – KEY FINDINGS

- ‘Time saving’ and ‘don’t have to go to the store’ are perceived as the two biggest advantages by 61% of online shoppers in Japan.

- The top 3 motivators for online purchases are ‘easy checkout flow’, ‘good reviews’, ‘star ratings’ as voted by 38%, 36%, and 31% of online shoppers, respectively.

- While the giants battle for the title of platform leader, both Amazon and Rakuten have ranked high for product discovery across all product categories in the last 12 months. 80% of online shoppers used Amazon and 71% of them used Rakuten for discovering new products.

• Online retailers are considered to be the top point of research when considering to buy a new product in Japan. Shoppers are twice more likely to choose this channel.

Japan online shoppers have been conventionally sluggish at adopting new behaviours, mainly due to their aging population. However, with the insurgence of people working from home, eCommerce in Japan has seen a significant upward growth trajectory as some traditional Japanese companies have had to switch to digital platforms, forcing Japan through digital transformation. Working patterns in Japan are leaving the population increasingly parched for time and this, in turn, fuels the growth of the eCommerce market. With numerous retail events spread across the year, 61% of Japanese shoppers find that the convenience and efficiency of the online experience are far better suited to their lifestyle than traditional shopping in a physical store. While making a purchase decision, Japanese shoppers are sensitive to payment choices and 38% of shoppers prefer platforms that offer easy checkout and payment options.

AUSTRALIA – KEY FINDINGS

- Unlike the rest of APAC, in Australia marketplaces are not the main online shopping destination. 67% of shoppers prefer brands’ websites for making online purchases.

- 66% of shoppers consider ‘shipping fee’ one of the main disadvantages of online shopping. 54% consider ‘shipping time’ a disadvantage. Also, the inability to touch and feel products before purchasing is perceived as another disadvantage by 46% of shoppers.

- Marketplaces like eBay and Amazon have ranked higher for product discovery across all categories in the last 12 months. 61% of online shoppers used eBay and 52% of them used Amazon for discovering new products.

Though 2020 was a year full of challenges, it was also one brimming with opportunity for Australian retailers. As social distancing, border closures, and lockdowns became commonplace, Australians turned online for the things they needed. And they did so in record numbers with 65% of the online shoppers making an online purchase at some point during a month.

Staying at home has changed the times that Australia shoppers purchase online and accelerated their adoption of eCommerce. The daily buying frequency is the same for both online and offline. Australians also really love good bargains; 49% of the shoppers get triggered to purchase when items are on sale followed by 47% by good reviews and 39% by easy checkout flow which shows how important product research and discovery is as more and more online shoppers are spending the time to explore.

Our research uncovered the top ways that Australians discover brands. Surprisingly, 37% of the online shoppers are still TV savvy followed by 33% who discover brands via online platforms. Given the diversity of platforms in Australia, 61% of online shoppers discovered new brands/products via eBay followed by 52% on Amazon. Although marketplaces are heavily sought after for discovery, 67% of online shoppers prefer to buy products directly from brand websites.

NOTES ON OTHER MARKETS – SOUTH KOREA

South Korea is one of the most developed e-commerce markets globally. With over 80% of its population using the internet, South Korea is the third-largest retail eCommerce market in APAC following China and Japan. Here the shopping is treated like an occasion that can be remotely attended. South Korea online retailers are enhancing their offerings to meet the new trend of live commerce, which combines streaming and e-commerce.

Despite being so progressive, one of the biggest challenges for online shoppers in South Korea is to be able to touch and feel products before they buy, 67% of the online shoppers felt this as a point of friction while 48% also cited the shipping fee as an obstacle. Regardless of these nuances, South Korea is a market that has the highest impulse buying rate (64%) both online as well as offline. When it comes to doing product research, Koreans rely very heavily on their search platforms; 62% of online shoppers use Naver to research new brands/products.

INDONESIA

The Indonesian economy is driven by its large population, declining poverty, and increasing middle class. With the internet penetration expanding, there is a massive thrust on digitalization which acts as a driver to eCommerce growth. The COVID-19 pandemic has further speeded up eCommerce sales in Indonesia. As a promising eCommerce market in APAC with a very cluttered landscape encompassing several local and global players; marketplaces are the main online shopping destination for Indonesians. 73% of online shoppers prefer marketplaces to brands’ websites for making online purchases. Despite having tremendous competition, certain marketplaces have stood out as the preferred shopping destinations for Indonesians. Currently, the international marketplace, Shopee, shows the most success in terms of product discovery as 86% of online shoppers engage with a new brand on that platform, followed by 71% on Tokopedia.

Frictionless Ecommerce becomes difficult in Indonesia, given the vastness of the country. 60% of shoppers consider ‘shipping time’ one of the main disadvantages of online shopping. 55% consider ‘difficult return process’ as a disadvantage. Also, the inability to touch and feel products before purchasing is perceived as another disadvantage by 52% of shoppers. An upside to being digitally savvy is to use newer sources of research; 73% of online shoppers say they research a product “all the time” before buying. Every 1 in 2 Indonesians refers to social media platforms to research brands and products, followed by 46% who rely on information from online search portals.

THAILAND

Thailand is the second-largest eCommerce market in SEA. A vast young population and an increase in internet and smartphone penetration, coupled with growing digitalization, has resulted in fast growth. During the lockdown stage, when people were encouraged to stay at home, more and more online shoppers go online via their mobile phones to do everything from work to shopping, entertainment and socializing.

Shoppers began spending more time on social media platforms, making Thailand the only market in SEA where 62% of online shoppers prefer to research brands and products on social media. Millennials seek convenience of returns when shopping online. However, across generations, it is the cheaper prices found online that drive shoppers in Thailand to participate in eCommerce. 64% of millennials compared to 74% of the older generation are motivated by promotions and discounts. Looking at the marketplace landscape in Thailand, the two most prominent players are Lazada and Shopee. Each of them has a particular customer perception; 75% of the online shoppers feel that Shopee offers better pricing and cheaper products whereas 67% feel that Lazada is more authentic in nature. In addition to these key players, Google shopping is gaining momentum in this market with 56% of online shoppers becoming aware of new brands/products via this channel.

MALAYSIA

At the current rate of Malaysia’s e-commerce growth, it is set to become the ASEAN digital pulse. With strong government support, the country has paved its way into eCommerce acceleration. A young population and social media growth have also aided the development of eCommerce in Malaysia. The survey uncovered that 66% of online shoppers in Malaysia are willing to try new brands and may not be loyal to any one brand. Perceived value for money and promotions are the second reason they prefer to shop online. The most common reason, apart from ‘shipping fee/time’, for not buying products online, across all product categories is ‘inability to touch and feel before buying.’ For ‘clothing, shoes and accessories,’ more than half of online shoppers cited this reason.

Product information is emphasized by 46% of online shoppers for making a purchase decision. Optimising product content on marketplaces has become critical for brands to stand out in the cluttered environment. Every 1 in 2 Malaysians do their product research online using social media platforms and almost 40% of the online shoppers also refer to online search portals for the same. Shopee deems to be a clear winner in terms of marketplace platform of choice, 92% of online shoppers have used Shopee to discover new brands in the last 12 months.

SINGAPORE

When COVID-19 first hit Singapore, the nation saw a massive sense of urgency in hoarding daily utility items. From toilet paper to ready-to-eat noodles, almost everything ran out of stock when the government announced its first lockdown in early 2020. The lockdown created a sudden and dramatic change in shopping behaviour, with more consumers turning to online shopping, as non-essential businesses and offices were required to close their offices and stores. Despite all challenges, the Singaporean government has been very supportive of the eCommerce industry. From upskilling its nationals by giving relevant training and jobs to providing them with eCommerce booster packages, the government has taken every step towards expanding eCommerce to SMEs.

Singaporeans not only shop locally but are avid international shoppers, making convenience the primary purchase trigger for 73% of online shoppers. They are also very price-oriented with 63% of Singaporean shoppers choosing to buy online to access better promotions and discounts. One peculiarity among Singapore shoppers is that 52% access brand websites to gather more information before making a purchase decision. This is almost 50% higher than other markets in SEA. With new restrictions coming in every few weeks, it is understandable that the best performing categories are groceries, restaurant, and food delivery services in addition to work from home-focused products including monitors, webcams, and even home office furniture.

HONG KONG

Being geographically close to China, Hong Kong is a market that everyone has their eyes on. Despite the proximity to the global eCommerce leader, Hong Kong has yet to accelerate at the same speed. With the onset of this pandemic, it has become clear for Hong Kong’s physical store retailers that they need to adapt to digitalization in order to survive. One such retailer is HKTV Mall who adopted the O2O model quite early in the pandemic, thus giving them leverage over their competitors. Consumers have trust in this retailer due to their decades of offline retail experience. This e-retailer has a very positive image amongst shoppers in Hong Kong. 86% of online shoppers also use HKTV Mall for discovering new brands and products online.

Unlike countries in SEA where marketplaces are the preferred shopping destination, 56% of Hong Kong shoppers prefer to buy directly from the brands’ website while making online purchases. 47% of online shoppers also use brand websites to gather more information before they make a purchase decision, unlike most other APAC markets.

PHILIPPINES

Philippines is one market that has not kept up with the eCommerce growth momentum compared to neighboring countries in SEA. Poor internet connectivity, a largely unbanked population, and its unique geography all lead to slower eCommerce growth. Filipinos are less brand loyal and highly price sensitive. Two out of three Philippine shoppers will try new brands they find online, and 57% of online shoppers also wait for products to go on promotion or discount before hitting the payment button.

More than half of the population would delay their purchases to leverage online sales.

Geography and logistics present a major challenge for online shoppers in the Philippines. 65% of online shoppers feel that returning a product is very difficult when shopping online. Metros enjoy access to malls and flagship stores along with shorter delivery times. However, suburban and rural areas where the majority of the online shoppers are located do not have access to such facilities. To service this audience, brands need to have a strong last-mile delivery service provider that can deliver packages nationwide. They must do that without drastically increasing shipping fees as this is another major cause of friction for 60% of online shoppers. Filipinos have one of the highest levels of internet penetration in the region and are the most active on social media. This channel is heavily used by shoppers not only to research products before they make a purchase (51%) but also for discovering new brands (60%).

VIETNAM

eCommerce in Vietnam was predicted to bloom during the national lockdown as people spend more time at home and online. However, this does not appear to be the case. Although there is a rise in the number as well as the shopping frequency of online shoppers, the growth in eCommerce is not at par with the market expectations. 41% of shoppers in Vietnam shop online a few times a week, compared to 36% who buy online a few times a month. Vietnamese online shoppers spend a large amount of time on the internet, when it comes to researching about new brands or products, 65% of shoppers rely on social media and 45% refer to brand websites.