MANILA, PHILIPPINES — theAsianparent (TAP), the largest content and community platform for parents in Southeast Asia reaching over 35 million users monthly, releases CONSUMER VOICE: Formula Milk Edition through its market research arm, theAsianparent Insights.

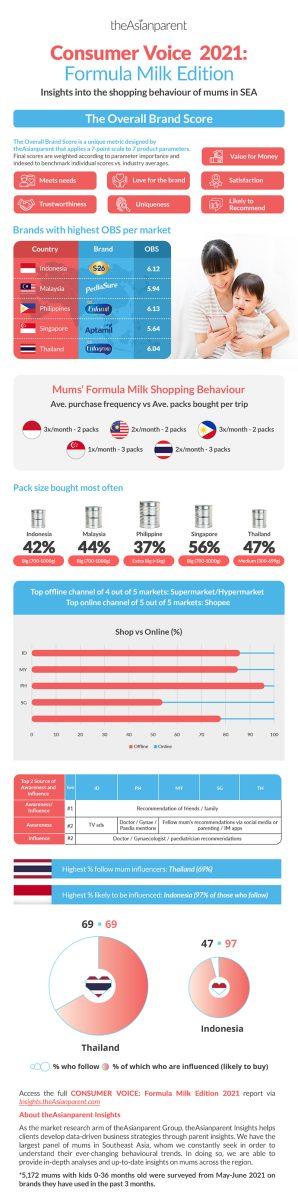

Using a 7-point scale on seven (7) product attributes highly valued by mom consumers, the report gives brands a clear snapshot of where they stand vs. their competitors according to brand users themselves in each of these markets: Indonesia, Malaysia, Philippines, Singapore, Thailand.

A Unique Metric: Overall Brand Score (OBS)

Over 5,000 moms were asked to rate formula milk brands they’ve used in the past three (3) months based on seven (7) parameters: Meets Needs, Trustworthiness, Love for the Brand, Uniqueness, Value for Money, Satisfaction, and Likely to Recommend. Overall brand scores (OBS), weighted according to parameter importance, ranged from 5.31 to 6.13 (out of 7). This created an index where brands clustered near industry averages, indicating high competitiveness in the category. The brands that came out on top varied across markets:

- Indonesia: S-26 is #1 in all parameters except uniqueness, where Pediasure takes the top spot.

- Malaysia: PediaSure, Enfagrow, and Karihome are the top 3 brands.

- Philippines: Enfamil is the #1 brand and has the highest OBS (6.13) in the entire report.

- Singapore: Aptamil and Dugro are the top 2, but scored lower vs. other markets’ top 5 brands.

- Thailand: Dumex is #1 in 6 of 7 parameters but came second to Enfagrow on OBS.

The report notes that across all markets, scores dip when it comes to uniqueness. TAP Regional Head of Insights, Malena Gong, comments: “This is a fascinating finding that we are happy to share with brands. It’s precisely what theAsianparent Insights aims to and is able to do given our massive community, tech capabilities, and the desire to bridge gaps between moms and marketers. Uniqueness is both a pain point and opportunity that brands can act on to win with moms, coming straight from moms.”

Understanding SEA Moms’ Formula Milk Shopping Behaviour

The report also touches on moms’ key consumer behaviours: Purchase Patterns, Sources of Awareness, and Circle of Influence.

The section on “Purchase Patterns” looks at the frequency of shopping trips, number of packs and pack size per shopping trip, as well as moms’ most preferred online and offline purchase channels. A finding of note is that most moms in the Philippines buy milk formula once every two (2) weeks with an average of six (6) packs a month, at par with Indonesia and Thailand. These moms also show the highest percentage in purchasing the extra big-sized milk packs (more than 1000g) compared to moms in the other SEA markets covered in the report.

On offline vs. online shopping: mom respondents in the Philippines have the biggest share of offline purchasers at 96% vs. 4%. They still prefer to make purchases at supermarkets and hypermarkets. For online purchases, moms in the Philippines opt for Shopee as the preferred e-Commerce platform to buy formula milk.

Under “Sources of Awareness” and mom consumers’ “Circle of Influence,” the report finds that across all markets, recommendations from family/friends are the top source of awareness (42%-54%) and the top purchase driver (44%-56%).

Other sources of awareness and influence to note: Fellow moms’ recommendations via social media or parenting/IM apps rank second in three out of five markets for awareness (42%-54%). Meanwhile, doctor/gynaecologist/paediatrician recommendations take the second spot across the board for influence (33%-51%).

“‘It’s all about conversations,” Gong adds. “‘Word of mouth’ isn’t restricted to generating buzz during campaign launches, but plays a key role in reinforcing brand trust—as waves of first-time moms seek advice on which products are truly suited to their various needs and so would make the best choice for their family. Many of these conversations are happening online, in mom circles and larger parent communities, swapping stories, tips, and unfiltered reviews. These are the spaces that demand listening.”

To read the full CONSUMER VOICE: Formula Milk Edition 2021 report, including country by country data and insights on preferred social media platforms and on mom influencers, access the report via Insights.theAsianparent.com.