SINGAPORE — Singapore stands as one of the smartest cities globally, with a staggering 99% of homes boasting internet access and 97% owning smartphones, according to the Infocomm Media Development Authority. Yahoo Singapore, in collaboration with Milieu Insight, delved deep into the daily habits and perceptions of 1,500 users in Singapore towards mobile apps and digital services, revealing intriguing insights into the digital landscape and potential societal concerns.

The study affirmed the nation’s high usage of mobile apps and services in their daily activities, including payments and transport. However, it found that there are differing views regarding the pace of technological change, the benefits and challenges of having new apps and digital services, and how these improve people’s quality of life, with several segments of society standing out.

Here are key findings and insights from “Clicks and Shifts: Yahoo Singapore Digital Study:”

Widespread adoption with most keeping pace with technology

Living in the smartest city in Asia, people in Singapore have largely kept up with technological advancements in their daily lives, with widespread adoption:

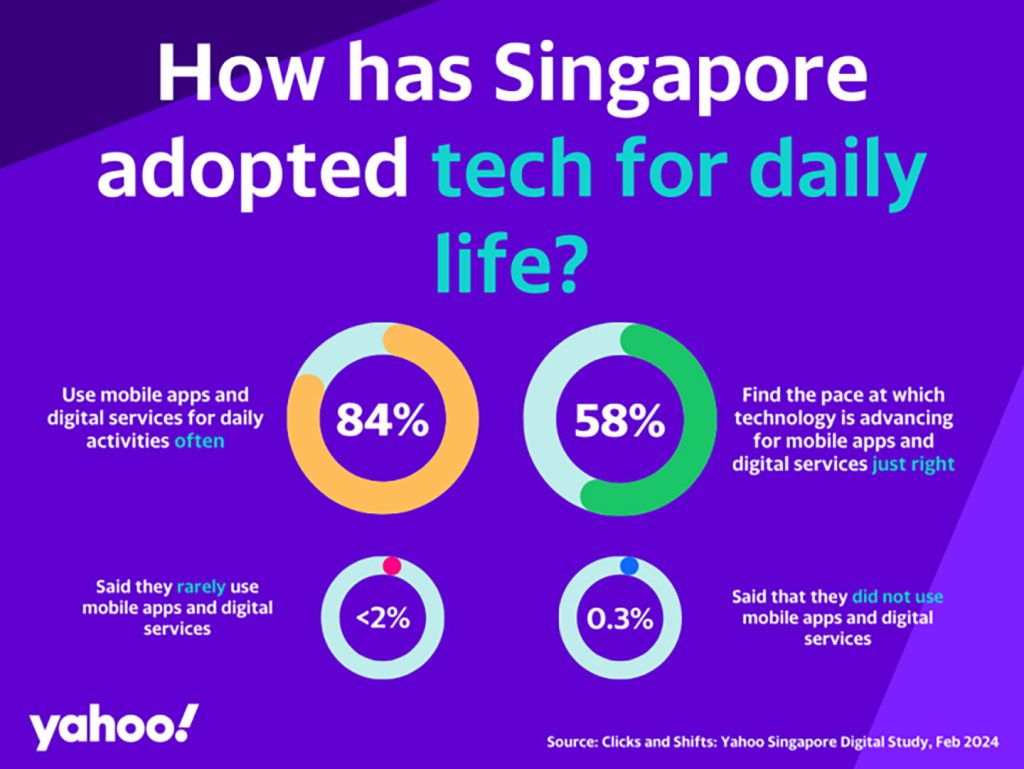

Most (84%) said they often use mobile apps and digital services for daily activities.

A significant (58%) also find that technological advancement for mobile apps and digital services is at the right pace.

While a majority were open to the benefits of mobile apps and digital services, a significant number were still on the fence about this sentiment:

More than half (64%) said the benefits of using new mobile apps and digital services outweigh their challenges and potential disruptions to daily life; 32% were undecided about its benefits, while 4% disagreed.

Over half (54%) said mobile apps and digital services improve their quality of life, while a substantial number (39%) were neutral about the sentiment, while 7% disagreed.

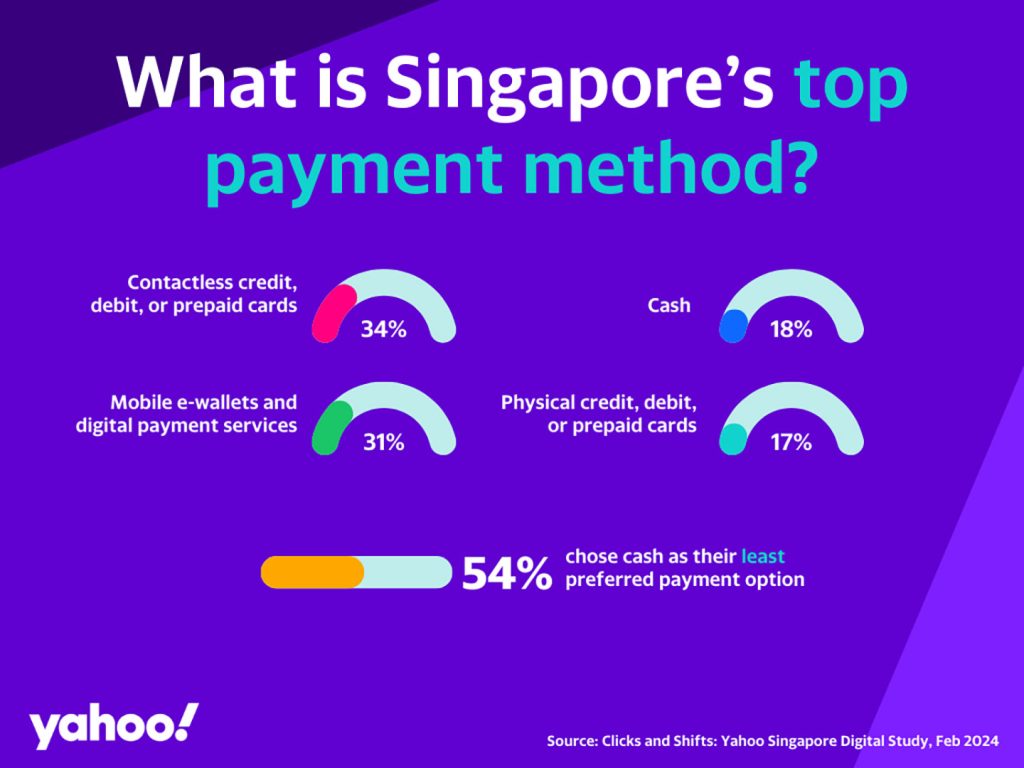

Cash is no longer king, mostly

People in Singapore prefer to go cashless — 34% of respondents ranked contactless credit, debit or prepaid cards as the most preferred payment method, followed closely by mobile e-wallets and digital payment services (31%). Strikingly, most (54%) of users in Singapore chose cash as their least preferred option.

The study also found that the preference for cash decreases as household income increases — cash remains the top payment method among households earning less than S$3,000 monthly (36%). In comparison, only 5% of respondents with household incomes of S$12,000 and more said the same.

Top payment methods varied among generational cohorts:

Millennials (41%) preferred contactless credit, debit, or prepaid cards;

Gen Z (38%) preferred mobile e-wallets and digital payment services;

Gen X tied between contactless cards (30%) and mobile e-wallets and digital payments (30%)

Baby Boomers (31%) preferred cash — but interestingly, 33% also ranked cash as their least preferred option.

From flagging to tapping – tech has evolved everyday commute

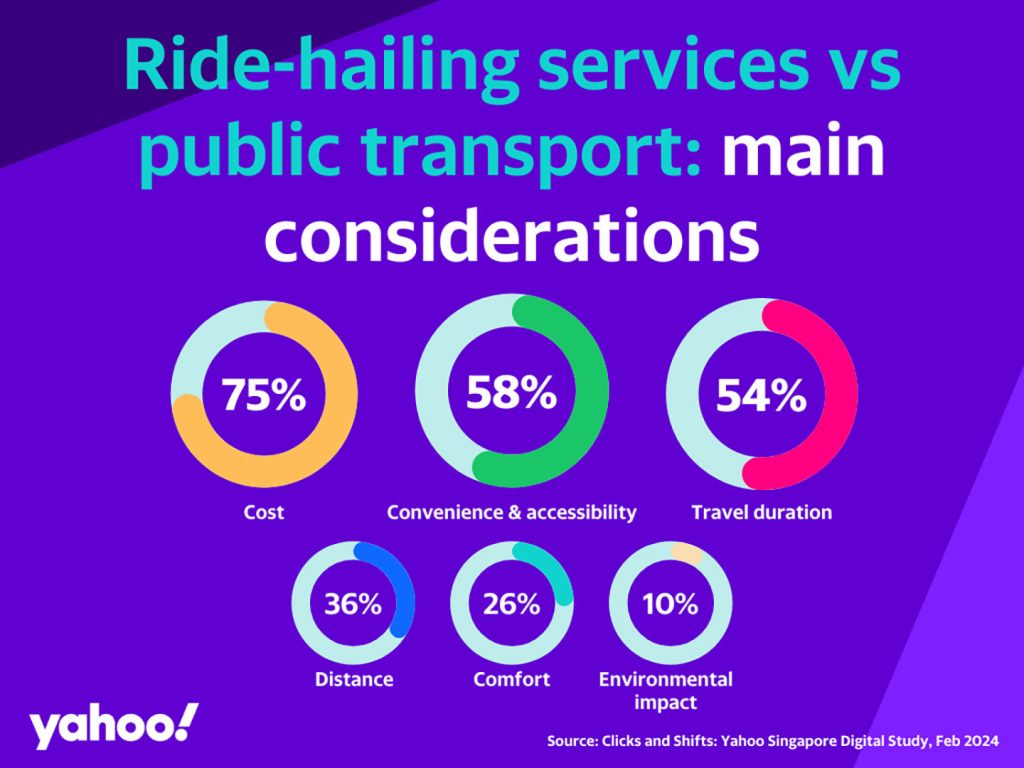

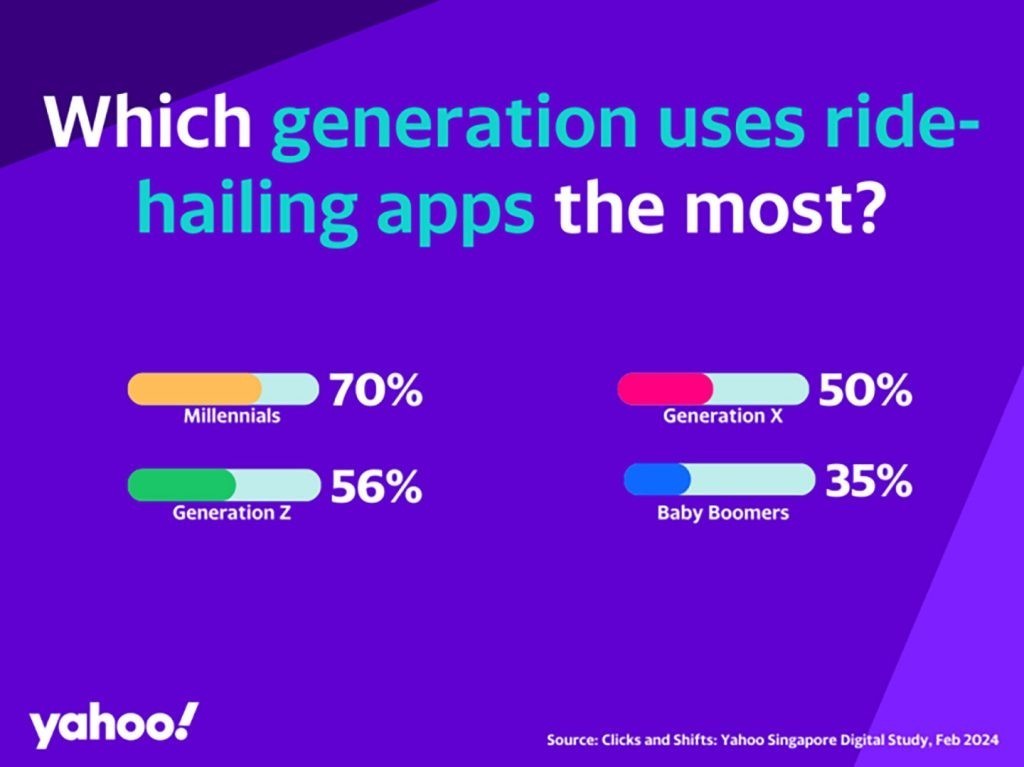

57% of the respondents said they use ride-hailing services at least once a week, with a majority (52%) using them 1 to 3 times a week. Among considerations when deciding between public transport and ride-hailing services, 75% chose cost as one of their options. This was followed by convenience and accessibility (58%), travel duration (54%), distance (36%), and comfort (26%). Notably, environmental impact (10%) was of least concern.

Of all generation groups, Millennials stand out when it comes to the usage of ride-hailing apps with 70% of them using it at least once a week. Compared to other generations, such as Gen Z (78%), Gen X (80%), and Baby Boomers (84%), Millennials were the least likely to prioritise cost (67%). Instead, they were more likely to prioritise comfort (31%) and travel duration (59%) than other generations – which might likely explain why they’re the top users of ride-hailing apps.

Among respondents who rode public transport, a majority (57%) said they use a mobile app or an e-wallet for payment-related matters, while 43% said they did not.

64% of those who use mobile apps or e-wallets for public transport utilized them to pay fares. 56% used it to check transaction history, 50% to check the balance of their card’s stored value, and 39% to top up their stored value in a card.

Meanwhile, among those who do not use mobile apps or e-wallets for public transport, a majority (76%) said they preferred using their physical card, 21% said their card had an automatic top-up function, while 10% preferred to pay cash.

Overall, 33% of users in Singapore prefer to use their physical card or token — the top reason why an individual might not use mobile apps or e-wallets for public transport. On the other hand, 36% indicate that they currently pay for fares using a smartphone or smart watch.

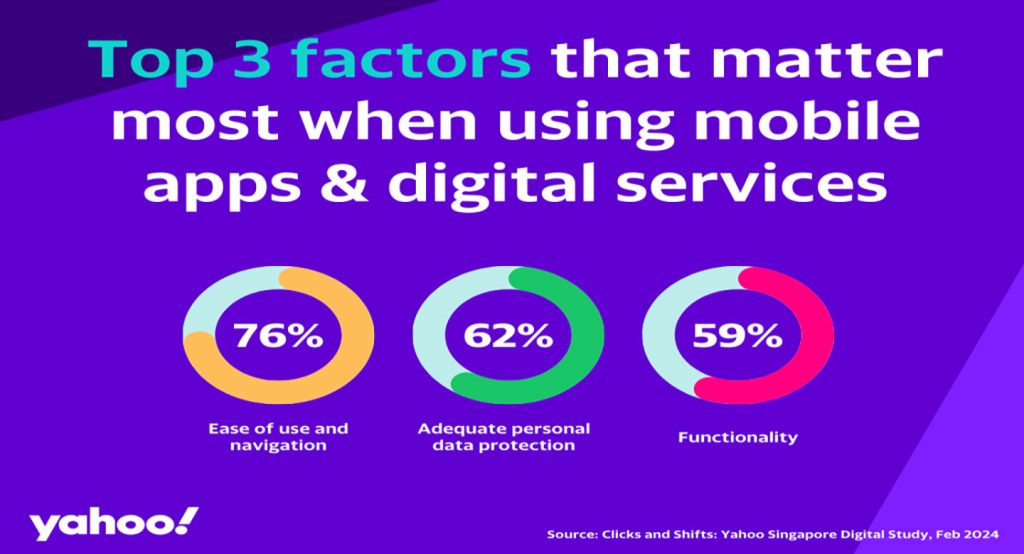

User-friendly interfaces, personal data protection, and functionality matter most to users

When asked to pick the top three factors when using mobile apps and digital services, a majority (76%) chose the ease of use and navigation of mobile apps and digital services, followed by the adequate protection of personal data (62%), and functionality (59%). Other factors were not of top concern to the majority; these include access to promotions and vouchers (29%) and appearance (9%).

Interestingly, older generations were more concerned about protecting their personal data, likely due to the rise in online scams, with it as one of the top concerns for Baby Boomers (76%), followed by Gen X (68%). In comparison, only 57% of millennials and 55% of Gen Zs indicated that a mobile app or digital service protecting their data is of top priority.

Baby Boomers are the most susceptible to tech advancements

A majority of Baby Boomers are frequent users of mobile apps and digital services — 72% using them often; not far behind the national average of 84%. However, the survey results indicate that while Baby Boomers generally do not have a negative perception towards mobile apps and digital services and instead might be on the fence; a considerable majority find the pace of change too fast, face inertia towards using new mobile apps and digital services, and find it much harder or are less likely to reap its potential benefits in daily life.

A majority of baby boomers (60%) said the pace of technological advancement was too fast. Only 43% of the next closest generation, Gen X, found it too fast, and only 36% of Millennials and 25% of Gen Z shared this view.

46% believed apps could improve their quality of life, lower than the national average (54%) – almost half (48%) were undecided, while 6% disagreed.

Only 49% said the benefits of learning new mobile apps and digital services outweighed challenges and disruptions, compared to the national average of 64%, and 46% were undecided, while 5% disagreed.

Baby Boomers were also less likely to use cashback or rewards features in payment apps, ride-hailing apps, and mobile apps or e-wallets for public transport.

Social factors such as affluence and educational level may impact how users use and benefit from apps and digital services

Although tech adoption is widespread across the board, affluence, and educational level may play a role in how users navigate and benefit from technological advancements and services – with those from lower household incomes and educational levels at risk of being left behind.

Those with higher household incomes and educational levels tend to use mobile apps and digital services more frequently — with 90% of those earning at least S$12,000, and 88% of postgraduate degree holders using them often. In comparison, those from lower household incomes (below S$3,000) use them less frequently — only 76% use them often, 19% use them sometimes, while only 40% of those with no formal education said they use apps often.

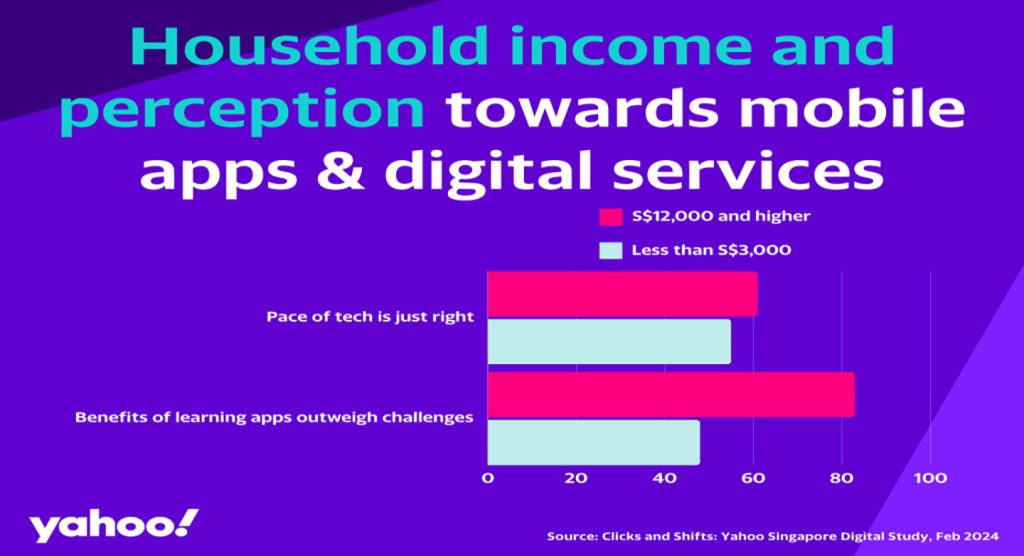

Those from higher-income households also have a more positive outlook towards mobile apps and digital services compared to those from lower-income households:

A majority of those with household incomes of S$12,000 and higher believe the pace of tech is just right (61%), and perceive the benefits of learning and using new mobile apps and digital services outweigh potential challenges and disruptions (83%).

In contrast, among those whose household incomes are less than S$3,000, only 55% believe the pace of tech is just right, and 48% believe that the benefits of learning and using new mobile apps and digital services outweigh its potential challenges and disruptions.