LONDON, UK — In this installment of WARC‘s APAC Spotlight series, Rica Facundo, WARC Asia Editor, delves into the burgeoning realm of social commerce, shedding light on the region’s pivotal role in propelling and revolutionizing this dynamic industry.

Social commerce is not a new phenomenon but it now goes by many names. From live selling to conversational commerce and shoppertainment, the rapid innovation in this sector is constantly blurring the lines of what’s working and what’s possible.

While China has been at the forefront of social commerce, the rest of Asia is making its own significant inroads and proving its worth as a market, especially with major players like TikTok Shop announcing its investment in Southeast Asia. In particular, Indonesia is the platform’s biggest market outside of the US.

In short, the social shelf is here to stay with Asia leading the way. But it’s complex and bears pulling apart its distinct components. This first-ever APAC spotlight explores questions such as:

- What are the common misconceptions about social commerce?

- How is Asia innovating and providing a glimpse of what other markets in the region and globally can learn?

- How is social commerce maturing amidst other trends in the industry?

Unpacking the complex social shelf

The “social” in “social commerce” means that most people tend to conflate it with only happening on social media platforms or networks.

However, the social element refers less to the platform it’s happening on and more on how the selling is a social experience. That’s why the ecosystem in Asia also consists of other types of platforms from marketplaces to chatapps and superapps that are making it confusing to navigate.

In his social commerce primer, Cube Asia’s Simon Torring explains that “social” and “commerce” are both “permeating the most widely used social and ecommerce platforms, and that brand new ‘native’ social commerce platforms are emerging in the middle where existing platforms are not able to bridge the gap”.

Another common misunderstanding is that social commerce and live selling, in particular, are conflated with shoppertainment.

Stickler’s Fionn Hyndman argues how it’s just another form of retail and not only a marketing activation: “Shoppertainment is too focused on the content and the community through entertainment/education. Often, brands are trying to entertain and put on a show when consumers just want to buy.”

Research by Milieu Insight shows that SEA consumers enjoy livestream sales videos to better understand a product in greater detail, with 39% citing it as a major reason.

Empowering the customer journey at every stage

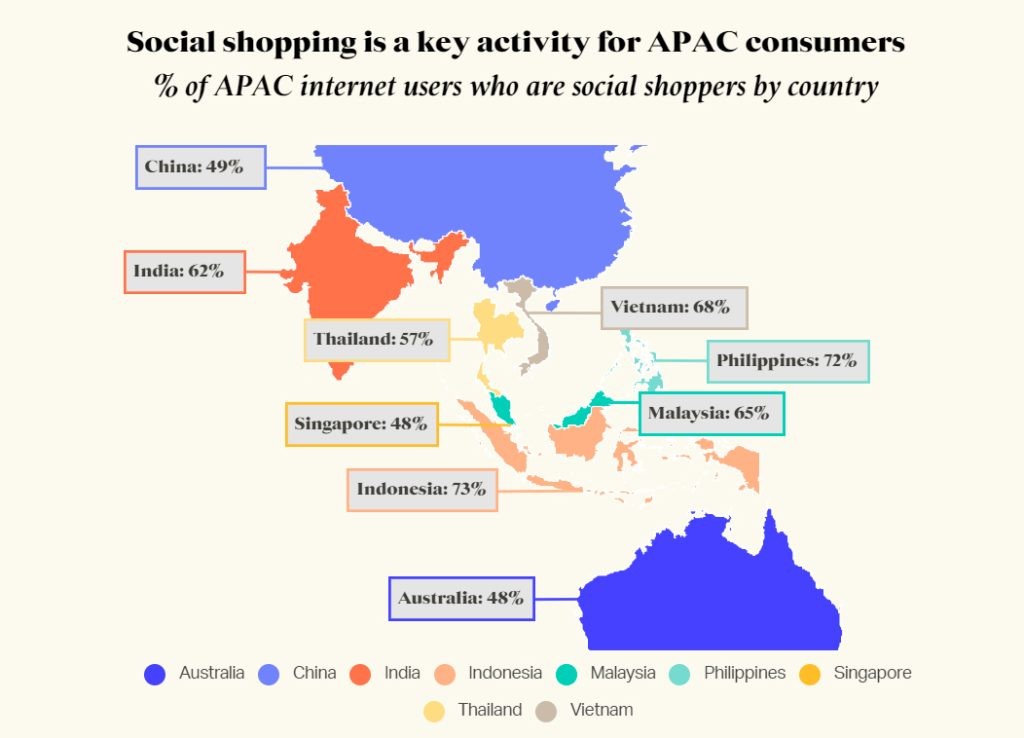

One of the biggest advantages of social commerce is its ability to successfully influence purchase intent at every step of the customer journey and effectively close the loop. For example, our spotlight infographic showcases how APAC consumers identify as social shoppers and use social media across various stages of their buying journey.

Based on a GWI survey of 170,824 respondents from nine key markets in APAC, Q2 2022 to Q1 2023. ‘Social shoppers’ are defined as any of the following: Those who say they discover brands via ads seen on social media; those who look for information about products on social media; those who are motivated to purchase by the option to use a ‘buy’ button on a social network.

Data is table stakes for marketers who want to engage with customers across this journey. In the face of cookie deprecation, messaging apps can give brands access to alternative first-party data.

Omnichat’s Alan Chan writes, “Marketers can capture first-party data such as customers’ WhatsApp/Facebook/Instagram/Line account ID, their browsing behavior and preferences, and order information through conversations in tandem with getting the consent of customers.”

This is a form of private traffic that ITC’s Aurelien Rigart says has been key to WeChat’s success in China.

“By focusing on private traffic management, brands can capture more brand-owned data from various touchpoints. This empowers them to create a more complete omnichannel view of customers, powering personalized marketing strategies and effective customer relationship management (CRM).”

Marketers must also understand how different formats can influence customers at the various stages of the customer journey, writes Ipsos’ Rai Falihah.

“For example, seasonal sales events have the potential to increase the brand awareness of a broad spectrum of audiences, from potential users to loyalists. Soft-selling approaches such as product tutorials or interviews with key opinion leaders could induce further interest in the brand.”

Despite the growth of social commerce, it’s important to note that Asian shoppers are not only shopping online, but across offline channels too. Marketers must start adapting social commerce as part of a larger omni-retail mix.

According to EssenceMediacom’s Josh Gallagher, “To win, brands must repair broken omnichannel experiences.” He recommends three strategic elements that need to play out in combination to achieve social commerce success – cultural relevance, personal relevance, and platform relevance.

A ‘social’ experience is important, but it’s not the only criteria for success

While the social element is the defining element of social commerce, it’s not the only feature that’s integral to conducting a great customer experience with social selling.

VMLY&R’s Amandeep Singh states that aligning the brand and customer experience is key to transforming this channel away from being just another form of customer service.

“Today, we live in a world where the very essence of a brand is the ‘experience’. A shopper chatting with your official brand account is therefore an experience that must be consistent and deliver on both quality and brand narrative. This means defining the persona, values, and tone of the messenger.”

Integrating payments into the experience is another invisible factor that gives platforms like TikTok an edge. Fionn coins this as “not having to cross the road” for payments.

“To be classed as live commerce, the transaction must take place in the same place as the video, whether the same app or the same domain. Ideally, this would happen in a frictionless way, where the consumer makes a few clicks and purchases without leaving the content they were browsing.”

People-powered commerce for buyers and sellers

Because of its social nature, social commerce is inherently a people-powered type of retail, which makes it an inclusive source of growth for the region.

Rapid development in AI is helping to propel conversational commerce through multilingual conversations.

Publicis’ Krishna Chandaluri says that: India is a linguistically diverse country with multiple regional languages. To cater to the vast user base, chatbots in India have focused on language adaptation. Many chatbots support popular Indian languages like Hindi, Tamil, Bengali, Kannada etc., enabling businesses to engage with customers in their preferred language. This localization has been crucial for successful implementation.”

Mindshare’s Manasa Harikar writes, “live selling has become a way to overcome geographic and socio-economic barriers by bringing stores home to shoppers who cannot access them. It helps them engage with brands in real time under a cover of anonymity, particularly where they might be shopping for products that would make them uncomfortable interacting in real life.”

Read more about best practices in social commerce by downloading our APAC spotlight report here or gain access to the infographic.

This article was initially featured on WARC’s official website.