GLOBAL — As countries in Europe, North America, and Asia have started to come out of lockdown, Africa has seen a steep rise in cases, with up to 100,000 confirmed cases of the virus, according to Reuters.

In Africa, traditional measures like quarantines and social distancing are difficult to implement, which is why non-profit SpeakUpAfrica, in collaboration with media group and creative agency Yard (part of the Sid Lee Paris collective), created a campaign to spread awareness.

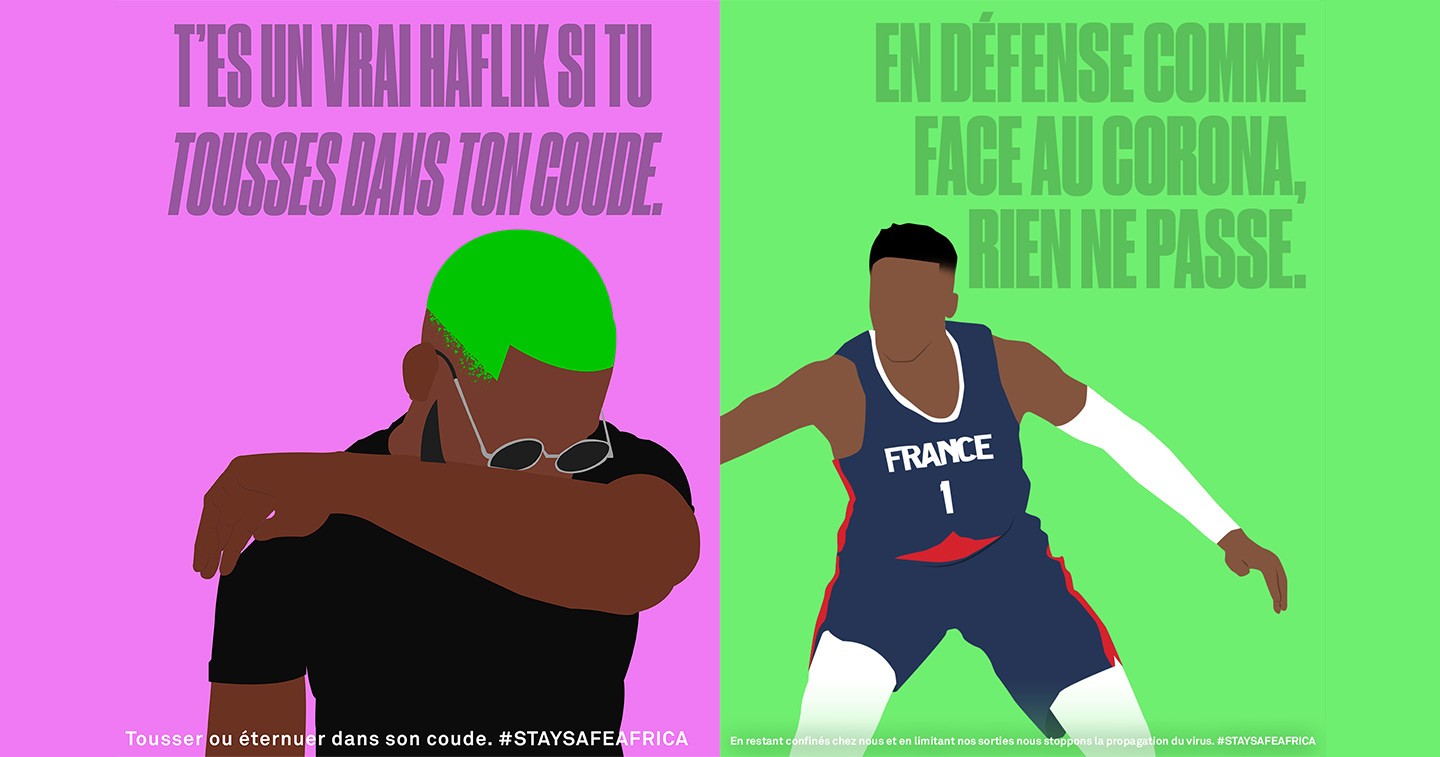

Working with artists, singers, and athletes, the two developed a series of vibrant “Cool Notices” graphic illustrations for well-known personalities to post online in order to reach the African youth.

Using their network, Yard reached out to actors like Omar Sy, athletes such as Knicks player Frank Ntilikina, fashion brands like Daily Paper and made in Africa shop Tongoro, and singers like French rapper Kalash 972.

Yard created personalized illustrations featuring their likeness and messages that play off their lyrics and catchphrases. The goal was to focus on the youth, who make up 70 percent of the continent’s population.

The campaign began at the end of April and continue through the foreseeable future.

SpeakUpAfrica champions action that reforms public health and sustainable development across the continent and have created a dedicated website to the cause: https://staysafeafrica.org.

Find more information about the NGO here

Credits:

YARD

Yoan Prat, Co-founder

Güllit Baku, Creative lead

Ugo Bortolotto, Junior AD

Antoine Mougenot, Junior AD

Maati Malki, Junior Copywriter

Cédric Leparmentier, Senior account manager

Jayde Mageot, Junior Account Manager

Ibrahima Gaye, Junior Account Manager

Lenny Sorbe, Journalist

Lansky, Journalist

About the Author

Theda Braddock is an American who lives and works in Paris. She helps agencies develop their communication and promote creativity, and writes for several publications when she has time.